The Employees’ Provident Fund Organization (EPFO) has around Rs.27,000 crore lying in inoperative accounts. There are chances that a small portion of this unclaimed money is yours. Many employees feel that the EPF account transfer is a cumbersome process and is a painful experience. It is often observed that we just ignore to transfer the funds to the existing EPF account.

But, things are changing for the better. The EPFO has been implementing good initiatives and you can now transfer your EPF funds online and you can also withdraw EPF funds online.

In case, you have not been contributing to EPF Scheme for a while and has not withdrawn/transfer the funds from your old EPF accounts then there are chances that your old EPF account(s) would have become IN-OPERATIVE.

As per the EPFO’s earlier definition of Inoperative Account – EPFO does not pay interest on the EPF account, where no contributions (no activity) have been received for 36 or more months continuously. EPFO considers this type of account as an ‘Inoperative EPF Account.’

However, during the FY 2016-17, the Ministry of Labour announced that interest will be credited on in-operative accounts too. Since then, there has been no clarity on this topic.

Interest on Inoperative EPF accounts – Latest Update

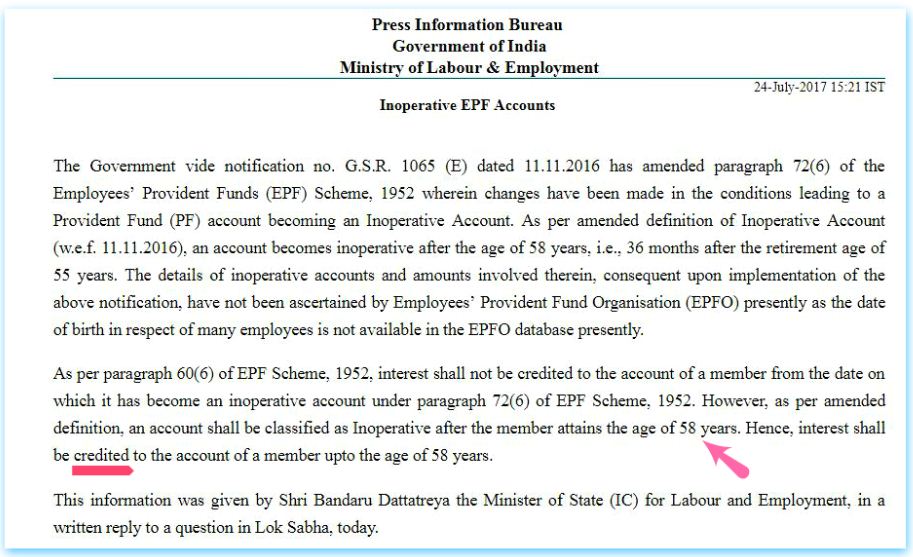

As per the EPFO, the retirement age of an EPF member is considered as 55 years. The PF body will pay interest on all EPF accounts (if full balance is not withdrawn) till up to the members’ age of 58 years. The rate of interest is as declared by the EPFO from time-to-time (every Financial Year).

New Definition of Inoperative EPF account : As per the amended definition, an EPF account becomes ‘inoperative’ after the age of 58 years i.e., 36 months after the member’s retirement age of 55 years.

So, it is now clear that an EPF account can be classified as Inoperative after the member attains the age of 58 years only.

If you are contributing to EPF Scheme, suggest you to check and verify the correctness of your personal details that are linked to UAN, especially your Date of Birth.

Latest update (16-Nov-2017) : If an employee who is a member of EPF scheme, quits or retires from his employment and continues holding the accumulated PF balance, he/she has to pay tax on interest from the date of unemployment. So, the interest on EPF is tax-exempt only when the member is employed and the Interest credited to an employee provident fund (EPF) account after an individual ceases to be in employment is taxable in his/her hands in the year of credit. Interest that has been accrued post employment is taxable. This is as per the recent order by Income tax appellate Tribunal.

(Source: Times of India & Moneycontrol)

Latest news (26-May-2018) : EPF interest rate for 2017-18. EPFO notifies 8.55% as interest Rate on EPF for the year 2017-18, lowest in 5 years.