The Finance Bill of 2022 introduced a new section called 194S in the Income-Tax Act, 1961, to levy 1% TDS on any consideration paid for the transfer of Virtual Digital Assets (VDA). Simply put, when you buy any Crypto (Crypto is considered a VDA), you (or the Exchange facilitating this transaction) will have to deduct and withhold 1% of the transaction value as TDS. This withheld Tax will have to be further paid to the Government.

Before we go into the details, here is a piece of good news for you: The Central Board of Direct Taxes (CBDT) has clarified that when someone is buying Crypto via an Exchange (even in the case of P2P transactions), Tax can be deducted under section 194S by the Exchange.

To help you understand these provisions better, here are a few explanations with examples:

- TDS provisions are applicable from 1 July 2022. These provisions will not affect any trades executed before 1 July 2022. As per these provisions, TDS would be deducted on each trade where a Crypto asset is exchanged for INR or another Crypto asset.

Please Note: If you have placed orders before the 1st of July 2022, but the trade happens on or after the 1st of July 2022, the TDS provisions will apply.

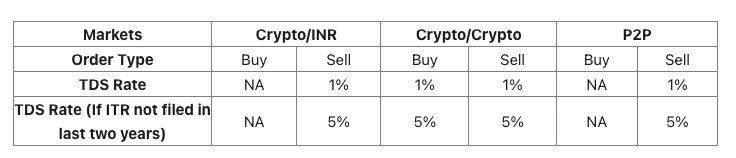

- No TDS would be deducted from the buyer on buying Crypto using INR, while the seller of the Crypto asset would be liable to pay TDS. However, when a Crypto asset is bought by paying with another Crypto asset, i.e., trading one Crypto asset for another, the TDS would be payable by both sides.

- Wherever applicable, 1% TDS will be deducted from the receivable INR or Crypto amount. However, as per Section 206AB of the Income-Tax Act, 1961, if the user has not filed their Income Tax Return in the last 2 years and the amount of TDS is ₹50,000 or more in each of these two previous years, then the TDS to be deducted (for Crypto-related transactions) will be at 5%.

- The TDS will be calculated on the ‘net’ consideration payable after excluding GST/charges levied by the Exchange.

- Any TDS collected in Crypto would be periodically converted into INR.

Summary

We hope this article helped you understand the TDS provisions on Crypto Curriencies. In case you have any questions, please feel free to drop a mail.