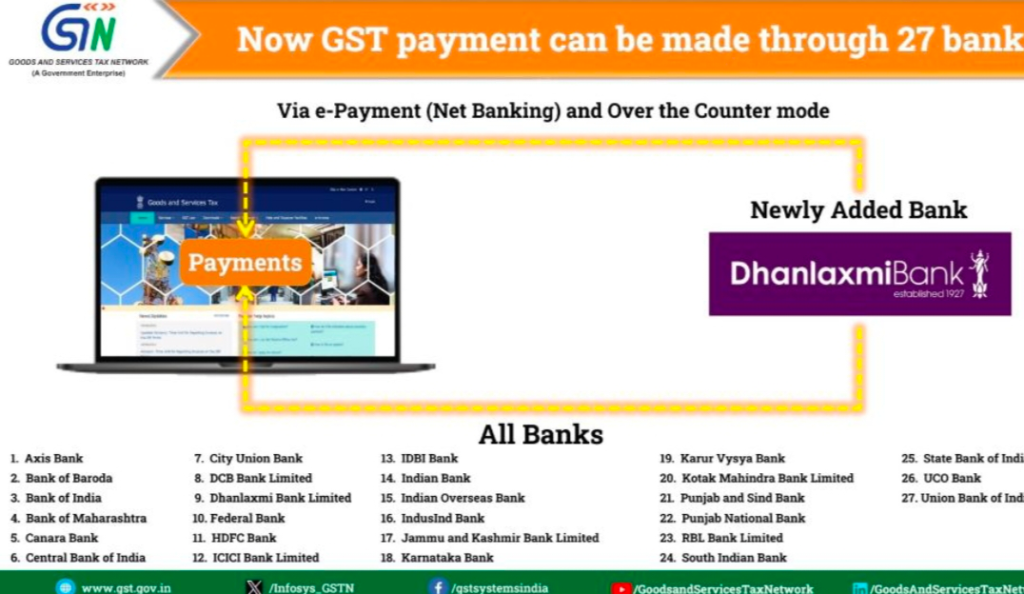

Paying your Goods and Services Tax (GST) has never been easier, with the option to make payments through various banks via e-Payment (Net Banking) and Over the Counter modes. The GSTN (Goods and Services Tax Network) has recently added 27 banks to facilitate this process, providing taxpayers with more flexibility and convenience.

The newly added banks for making GST payments are:

- Dhanlaxmi Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- City Union Bank

- Federal Bank

- HDFC Bank

- ICICI Bank Limited

- IDBI Bank

- Indian Bank

- DCB Bank Limited

- Dhanlaxmi Bank Limited

- Antorys, GSTN

- All Banks

- Axis Bank

- Indian Overseas Bank

- Indusind Bank

- Jammu and Kashmir Bank Limited

- Karnataka Bank

- Karur Vysya Bank

- Kotak Mahindra Bank Limited

- Punjab and Sind Bank

- Punjab National Bank

- RBL Bank Limited

- South Indian Bank

- Union Bank of India

- State Bank of India

- UCO Bank

With these options, businesses and individuals can conveniently fulfill their GST obligations, ensuring compliance with tax regulations.

For more detailed information on making GST payments through these banks, visit the official website at get.gov.in.

Whether you prefer the ease of e-Payment through Net Banking or the in-person service of Over the Counter mode, these added banks aim to streamline the GST payment process for all taxpayers.